The Netherlands continues to dominate the global superyacht industry, maintaining its position as the world’s leading producer of luxury vessels longer than 80 metres, according to a new sector expertise report from ABN AMRO.

The Dutch superyacht sector has proven remarkably resilient despite a cooling market following record-breaking years during the pandemic. While the industry faces new challenges, innovative approaches and a shift towards adventure-focused vessels are creating fresh opportunities for growth.

Netherlands Leads in Premium Vessel Construction

Dutch shipyards excel not through sheer volume but through the exceptional length and quality of their builds. In 2024, the Netherlands was the world’s largest producer of new superyachts exceeding 80 metres, with nearly 70% of Dutch production consisting of bespoke vessels designed entirely from scratch according to client specifications.

The ABN AMRO report highlights that renowned Dutch superyacht builders including Feadship, Oceanco, Heesen Yachts, and Royal Huisman continue to attract clients seeking specialisation in custom work, innovation, and craftsmanship. The average length of Dutch superyachts reaches 71 metres, reflecting the industry’s focus on larger, more sophisticated vessels.

This premium positioning comes at a price point of approximately €1.3 million per metre for superyachts, up from the previous rule of thumb of €1 million per metre. Additional length and luxury features often drive the final price per metre even higher, according to HISWA-RECRON data referenced in the report.

Market Shows Signs of Normalisation

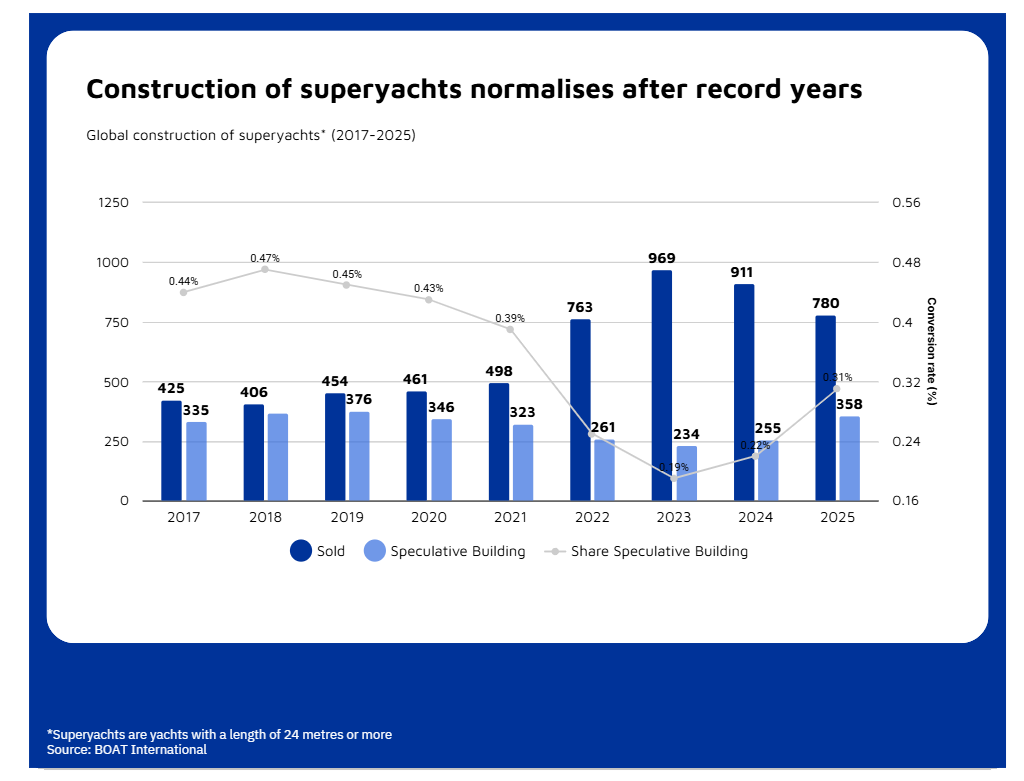

Following unprecedented growth during the coronavirus pandemic, the superyacht market is returning to more sustainable levels. Global superyacht sales have declined in recent years, with the market appearing to cool after record-breaking performance and returning to normal patterns.

The ABN AMRO analysis reveals that Dutch superyacht turnover fell 8.5% in 2023 compared to 2022. However, export value surged 48% in the same period, likely reflecting the delivery of vessels ordered during the pandemic boom years, as superyacht construction typically takes several years to complete.

Russian sanctions following the February 2022 invasion of Ukraine temporarily impacted delivery schedules, as previously ordered superyachts for sanctioned Russian buyers could not be delivered. These vessels were subsequently sold to buyers from other countries, often with interior modifications, causing delivery delays.

Speculative Building on the Rise

An increasing number of shipyards are beginning superyacht construction without secured buyers, a practice known as “speculative building”. This approach allows yards to respond more quickly to clients wanting immediate delivery whilst maintaining more stable production capacity utilisation.

The ABN AMRO report shows speculative building accounted for 19% of projects in 2023, rising to 31% by 2025. This trend is particularly pronounced for smaller superyachts between 24 and 27 metres, where 40% of construction is speculative. In the Netherlands, more than a quarter of superyacht construction is now speculative.

Adventure Yachts Drive New Market Growth

The market is shifting from traditional luxury focused buyers towards younger, technology-driven clients seeking adventure over standard luxury. Expedition yachts are becoming increasingly popular—more compact vessels with robust designs suitable for remote destinations such as Antarctica or the Southern Ocean.

These adventure-focused superyachts prioritise autonomy, enabling extended independent operation in challenging conditions. The Xplorer 60, built by Dutch shipyard Damen, exemplifies this trend with its 60-metre length, hybrid propulsion system, and ice-class certification. Over the past decade, the number of expedition yachts has nearly doubled from 55 to 110 vessels, according to data from The Global Order Book 2025.

Industry Employment and Economic Impact

The Dutch superyacht industry employs approximately 6,500 people, with roughly 3,000 working directly for superyacht builders and 3,500 for suppliers. According to ABN AMRO and HISWA-RECRON calculations, Dutch superyachts held approximately 25% of the global market share in 2023.

The Global Order Book 2025 data confirms the Netherlands’ strong position with 69 projects totalling 4,483 metres of construction. While this represents a decrease of 11 projects from the previous year, the report notes this reflects the completion and delivery of previously frozen Russian orders rather than genuine market decline.

Private Equity Investment Increases

The Dutch superyacht industry, traditionally dominated by family businesses, is seeing increased involvement from private equity firms and external financiers. Recent examples include Royal Huisman Group, Vanquish Yachts, and Steeler Yachts, which now have partial private equity ownership.

This trend reflects growing capital requirements as companies seek to capitalise on rapid market growth. The need for expansion and development is driving businesses to seek external investment to fund growth initiatives.

Export Markets and Trade Implications

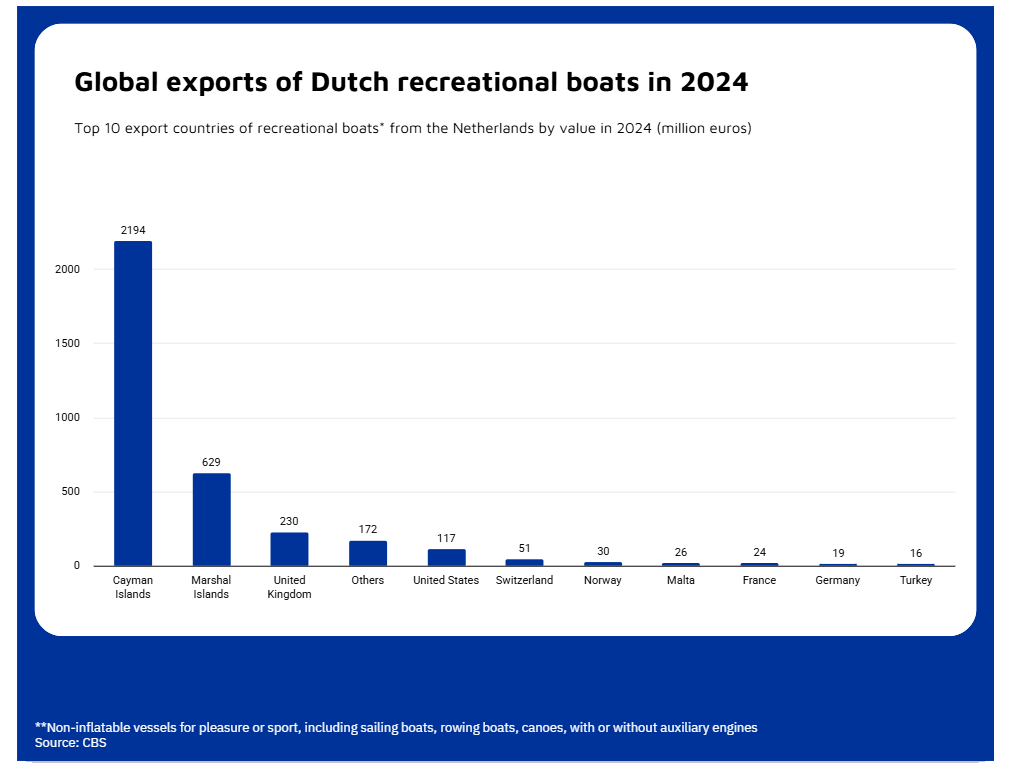

Despite concerns about potential US import tariffs under the new Trump administration, industry representatives expect minimal impact on Dutch yacht builders. Although 24% of yachts over 40 metres are owned by Americans, flag state registration can easily be adjusted.

Popular flag states include the Cayman Islands, Marshall Islands, United Kingdom, and Malta, with superyachts commonly operating under these flags. CBS (Statistics Netherlands) data shows total Dutch pleasure and sport boat exports reached €3.6 billion in 2024, with the majority representing superyachts. Only 3% of exports were destined for the United States, with most going to the Cayman Islands, Marshall Islands, and United Kingdom.

Looking Forward

The Dutch superyacht industry’s focus on quality over quantity, combined with expertise in custom builds and innovation, positions it well for continued success. The shift towards expedition yachts and adventure-focused vessels aligns with changing client preferences, particularly among younger, tech-savvy buyers seeking unique experiences.

Whilst the market normalises after pandemic highs, the Netherlands’ reputation for craftsmanship and ability to deliver complex, bespoke projects ensures its continued leadership in the premium superyacht sector.

The industry’s adaptation through speculative building, embrace of new market segments, and strategic investment partnerships demonstrates its resilience and forward-thinking approach to evolving market conditions.

This article is based on the ABN AMRO sector expertise report “Nederlandse superjachten blijven populair” and supplementary data from The Global Order Book 2025.